Diamond Industry in Uproar as Social Media Calls for Boycott of Rapaport Diamond Prices

While some argue that the recent social media campaign against Rapaport Group is driven by vested interests, the industry consensus remains that RapNet is the world's diamond pricing authority, and its influence cannot be overlooked. Jewelers and buyers worldwide rely on RapNet's diamond pricing when conducting business with Indian diamond companies.

Advertisement

Surat : The diamond industry in Surat and Mumbai has been shaken by a wave of viral messages circulating on social media, calling for a boycott of the renowned US-based Rapaport Group’s diamond pricing.

The messages urge diamantaires to abandon Rapaport’s pricing and instead rely on the dollar price per carat for trading polished diamonds. This outcry comes in response to the Rapaport Group’s recent decision to implement price cuts ranging from 1% to 9% across all types and sizes on its diamond trading platform, Rapnet.

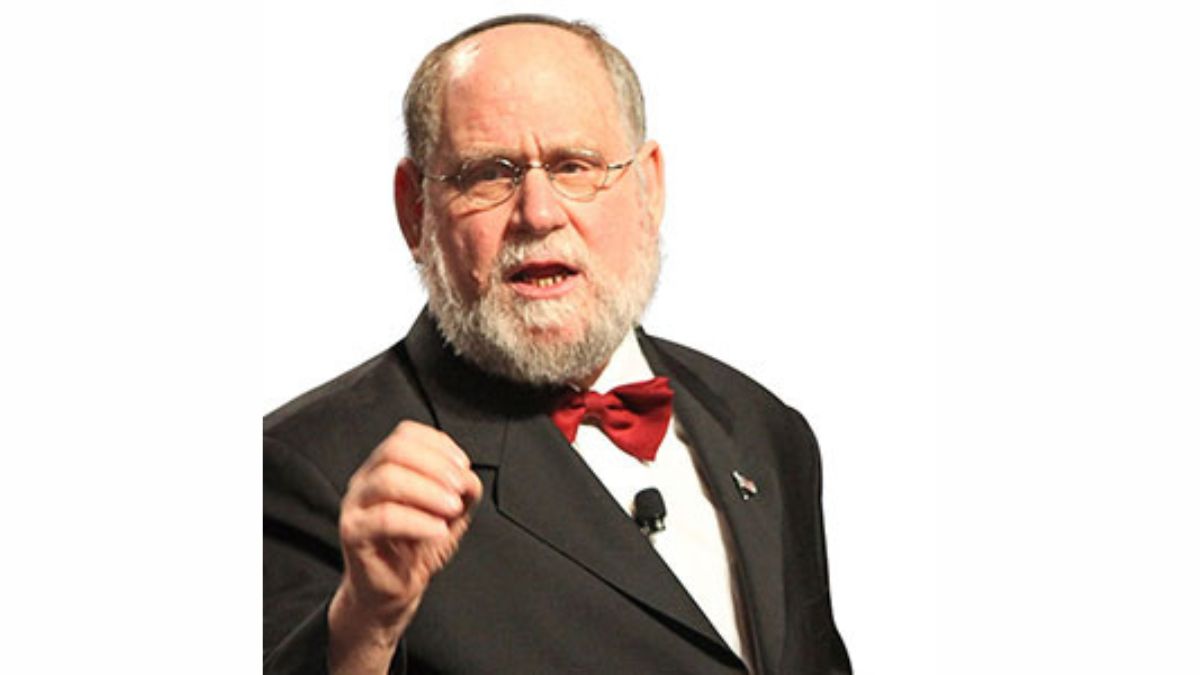

This is not the first time that Martin Rapaport, the owner of the Rapaport Group, has found himself at odds with the diamond industry. In 2020, hundreds of diamond companies withdrew their goods from RapNet when Rapaport reduced prices by an average of 7% across all diamond categories.

RapNet, the industry’s largest and most trusted online marketplace for sourcing and selling diamonds and jewelry, sets the benchmark for diamond prices in the international diamond trade. Approximately 99.9% of diamond companies in India, primarily those dealing in diamonds above 30 cents, are registered on Rapnet’s platform.

While some argue that the recent social media campaign against Rapaport Group is driven by vested interests, the industry consensus remains that RapNet is the world’s diamond pricing authority, and its influence cannot be overlooked. Jewelers and buyers worldwide rely on RapNet’s diamond pricing when conducting business with Indian diamond companies.

To illustrate the significance of RapNet’s pricing, if a diamond with a specific cut and clarity is listed for $1,000 per carat on the platform, there are players in the industry who are willing to sell at prices significantly below that benchmark.

Even the lab-grown diamond dealers are taking the benchmark diamond prices of the Rapnet to deal with their international clients.

In response to the social media campaign in Surat, Martin Rapaport, Chairman of the Rapaport Group, highlighted several factors contributing to the decline in diamond prices. These factors include the impact of lab-grown diamonds on natural diamond sales, a slowdown in China’s economy, and reduced spending in the United States due to higher interest rates and inflation.

Rapaport Group contends that decreasing disposable incomes worldwide have led to reduced consumer spending. Martin Rapaport expressed sympathy for diamond dealers facing unprecedented challenges but emphasized that the purpose of the price list is to accurately reflect market conditions and establish a fair benchmark for both dealers and buyers.

“I am doing my job—to communicate diamond prices and to establish a fair balance,” Martin Rapaport stated, “It is very sad that people are losing money, but Rapaport has to report the truth,” he concluded.

“The controversy surrounding Rapaport Group’s pricing policies has ignited a fierce debate within the diamond industry, with diamantaires and industry stakeholders closely watching for any developments that may impact the future of diamond trading and pricing” said a diamond industry analyst in Surat.

Advertisement