Surat : IT launches investigation into hawala racket of diamond, medical device companies

Exporters have not received the overdue payments from abroad, which would have been placed into their bank accounts via proper banking channels since they exceed the credit limitations. This has led to speculation that the export of luxury items from Surat and the surrounding area of south Gujarat is really a front for a sophisticated hawala enterprise.

Advertisement

Surat : The Surat Income Tax department has launched an investigation into the exporters not receiving the overdue payments from abroad through their official banking channel, suspecting a hawala racket.

As part of its inquiry, the department has asked the Directorate General of Foreign Trade (DGFT) for a list of local exporters operating in Surat and the south Gujarat area.

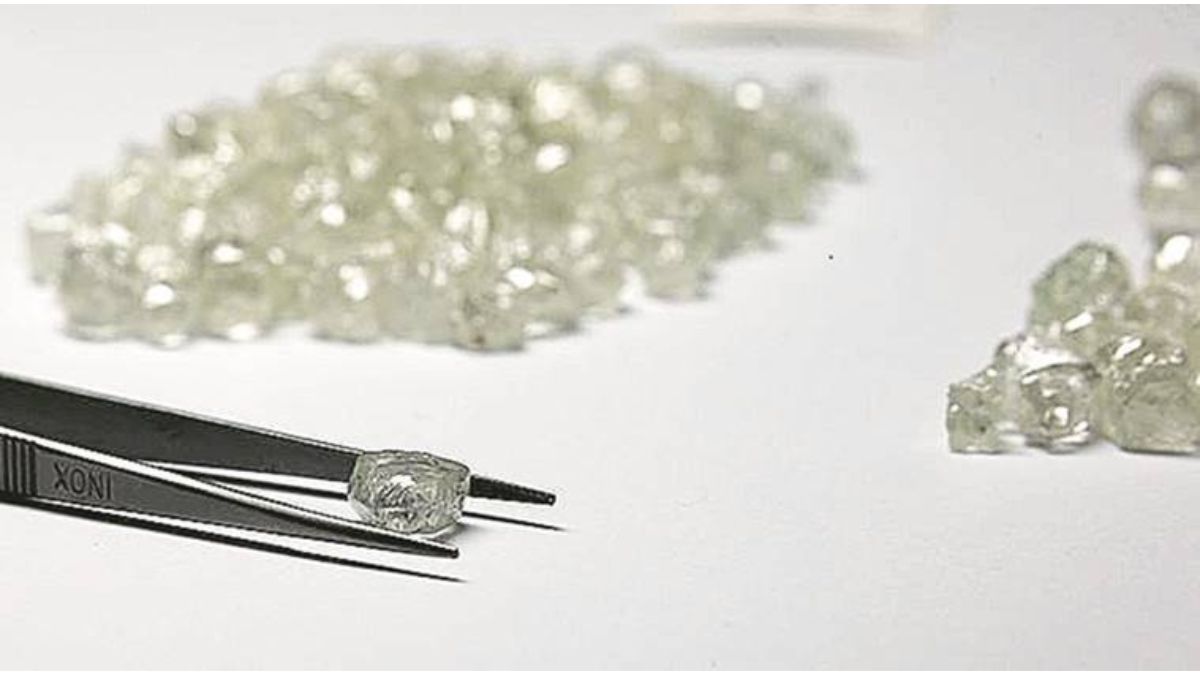

It has come to light that several Surat exporting companies continue shipping high-priced items like diamonds, stents, and medical gadgets to different parts of the world. Unfortunately, the exporters have not received the overdue payments from abroad, which would have been placed into their bank accounts via proper banking channels since they exceed the credit limitations.

This has led to speculation that the export of luxury items from Surat and the surrounding area of south Gujarat is really a front for a sophisticated hawala enterprise.

Surat is the hub for medical device manufacturing, particular stents used in the heart disease by the doctors in India and abroad. Through their foreign entities, these medical device companies are exporting stents to the foreign buyers providing huge commission amount.

Tax Collection at Source (TCS) requires exporters to acquire a certificate from the destination detailing the amount of tax that will be withheld from the recipient upon delivery of the goods. This certificate may be used to verify the recipient’s citizenship status or lack thereof.

Exporters may bring the certificate to the tax department for clarification if any of the information is inaccurate. If an individual or business is subject to both a federal and a state income tax, the greater rate applies.

The probe might have serious repercussions for the manufacturers accused of participating in the hawala scheme. If an Indian manufacturer is a partner in a foreign firm, he or she is required by Indian law to declare any income earned by the partnership in India. This implies that there may be legal consequences for any offshore income that is not declared.

Advertisement