De Beers schedules 10 auctions in 2026 amid diamond slump

Mining major signals price negotiations as natural diamond demand crashes under pressure from lab-grown alternatives

Advertisement

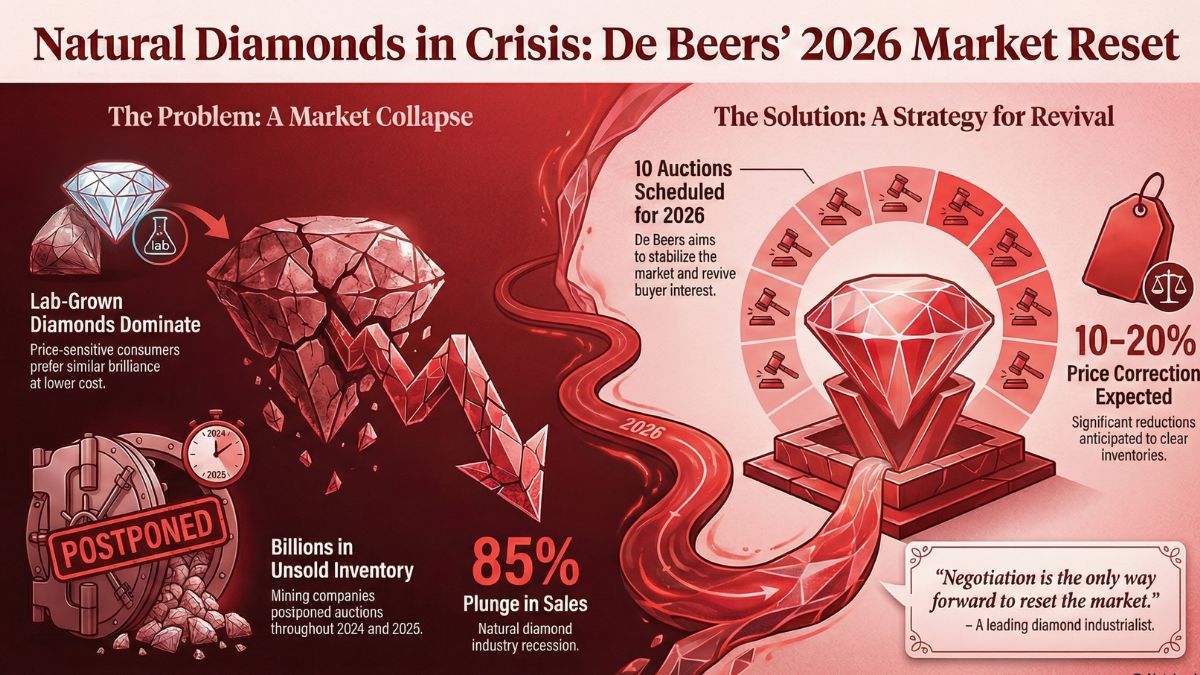

Surat | Gujarat — In a strong signal of changing dynamics in the global diamond trade, mining giant De Beers has scheduled 10 public auctions of natural rough diamonds in the 2026 calendar year, as companies prepare to negotiate prices to clear massive unsold inventories accumulated during the prolonged recession in the diamond and jewellery market.

The global natural diamond industry is facing one of its toughest phases in decades. Industry sources estimate that the sale of natural diamonds—both rough and polished—has declined by nearly 85 per cent worldwide. From the US and Europe to Dubai and Hong Kong, lab-grown diamonds have rapidly overtaken the market, offering similar brilliance at a fraction of the cost. With consumers increasingly price-sensitive, natural diamonds are now widely perceived as expensive, pushing demand sharply downward.

During 2024 and 2025, several natural rough diamond mining and supply companies were forced to postpone auctions repeatedly, leaving billions of rupees worth of rough diamonds unsold. However, with the downturn showing no immediate signs of reversal, mining companies have begun adopting a price-negotiation strategy to stabilise the market and revive buyer interest.

According to industry information, De Beers will conduct its 2026 auctions in Gaborone, Botswana, where it traditionally sells nearly 90 per cent of its rough diamonds to registered sightholders. The auction calendar has already been communicated to sightholders across key diamond centres, including Surat and Mumbai.

A leading diamond industrialist from Surat said the market sentiment remains heavily tilted towards lab-grown diamonds. “At present, demand for lab-grown diamonds is so strong that buyers are not even enquiring about natural diamonds. Mining companies sought feedback from sightholders, and almost everyone suggested price reductions,” he said. “Company officials have assured us that the issue will be considered sympathetically.”

Industry insiders are cautiously optimistic that upcoming auctions may see price corrections of 10 to 20 per cent, a move expected to help clear inventories and gradually restore confidence in the natural diamond segment. “The market has collapsed over the last two years. Now negotiation is the only way forward to reset the market,” the industrialist added.

Advertisement